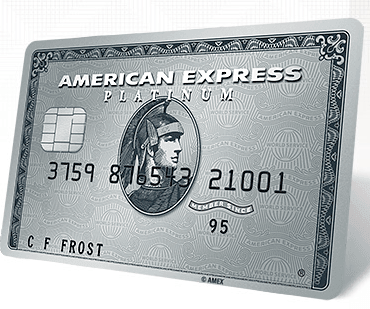

Advantages and disadvantages’an American Express credit card

American Express, often referred to as “AmEx,” differs from most other credit card issuers in that’it is also a bank. With d’other cards, such as Visa or MasterCard, there is a bank that backs the card. American Express offers many card options for personal or business use.

They also have cards designed for the young or wealthy. An American Express credit card has many pros and cons.

Benefits

L’Use of the card’An American Express card can have many advantages. L’One of the most rewarding is the cash back offered on many cards. These discounts often go up to’at five percent on regular purchases, more than what Visa or MasterCard’s competitors offer. Unlike other credit cards, there are no other advantages’There is usually no pre-determined spending limit on an American Express card.

A good credit report or credit history with AmEx, and time as a customer will allow you more freedom with your card. Finally, the customer service of’American Express is known for its excellent quality. Concierge services are available to help you plan your travel or simply book your dinners.

Disadvantages

With something good, there’s always something wrong. The disadvantages of’American Express includes a notorious annual fee. While there is an annual fee, the actual fee varies as such. In some cases, the annual fee is waived the first year, or sometimes the first two years, for simply signing up or agreeing to spend a certain amount per year, according to 100 Best Credit Card Reports. Another negative is that American Express does not require full monthly payments’It is not widely accepted like other credit cards.

If you use this card for most of your purchases, it may be good to’You’ll be able to make the right decisions when it’s time to get another type of card in case they don’t work out’Would not accept American Express. When American Express first began offering credit cards, it was to be the first to offer them’The disadvantages of American Express are that they are not real cards, which means that they are not as easy to use as real cards’that is, the balance had to be paid in full each month. At the’Currently, not all American Express cards require full monthly payments, but many do; make sure to check with your credit card company’understanding the terms and conditions’use. Finally, your rewards options are relatively basic, which largely means only cash options.

If you try to use it, you’ll find that it’s not the most rewarding’With the ability to earn flight miles or understand the terms and conditions of’other merchandise, American Express is not a’is probably not the best option.

Factors to consider

When you choose to’When using an American Express credit card, it is important to consider your needs and preferences: will you’Use for most of your purchases, do you travel a lot, will you have the control needed for an unlimited card ? Once you’ve determined what you need to do, you’ll need to make sure that it’s right for you’If you have a card, you will be able to choose appropriately if you want to ask AmEx for one or not. If you choose to use them’Whether or not you use an American Express card, it can be a good idea to use it’to have another card in case of’emergency. Having a backup of’another transmitter will not cost you anything but it can be very useful.